Abstract

Understanding users is crucial to designing delightful experiences for them. This paper provides a case study on how we gained a better understanding of our users before we redesigned Quotient’s (formerly Coupons Inc.) user experience. Before identifying personas at Quotient (www.coupons.com), we never truly explored the behaviors and needs of our consumers other than assuming that she is a busy mom trying to save on her groceries with coupons. This case study shows the approach in determining three personas for our “couponers”: budget, high value, and convenience. We also have examples of how these personas influenced the overall user experience and how the personas were communicated to and shared with employees at Quotient.

Keywords

Persona, design, influence, user experience, design methodology, research methods, design communication

Introduction

Alan Cooper created personas and introduced the them in his famous book The Inmates Are Running the Asylum: Why High Tech Products Drive Us Crazy and How to Restore the Sanity in 1999. He described personas as user archetypes that help guide decisions about product features, navigation, interactions, and even visual design. By designing for the archetype, whose goals and behavior patterns are well understood, you can satisfy the broader group of people represented by that archetype. Personas help designers create different designs for different kinds of people—designing with a specific somebody in mind, rather than a generic everybody. Many people think of a persona and the document that captures essential elements of that persona as the same thing, but it is not. The journey to make a persona document should not take away from the bigger picture, which is to fully understand a user and then share the top-level information with others. In this paper, we explored that journey and provided some practical applications of how this journey influenced the user experience of our website and mobile app.

At Quotient, we use a wide range of user research methods to better understand our users, ranging from in-the-wild studies, to focus groups, to usability tests and surveys. We decided to incorporate personas into our research method pool as a means to empower our team and to delight our users. When a persona is portrayed vividly, a design team can better imagine the user’s goals and motivations, which leads to better-oriented discussions (Pruitt & Adlin, 2006). Another important benefit of using personas is that the design process can focus on emphasizing the user and their goals, and not on their tasks. Designing by tasks instead of goals is a common mistake that leads to ineffective interactions because tasks are not steady and are often transient (Blomquist & Arvola, 2002).

Because we are also aware of persona limitations in being a collection of attributes to represent broad segments of users, we chose to talk to a small group of real users. In this study, we followed 12 users (4 from each persona) to see how they planned their grocery shopping trip and how they shopped in the store. We did this to better understand the entire journey of these personas and why they (our representative participants) made the decisions they did. This was a critical step in getting buy-in from stakeholders and helped to convince stakeholders more than the actual persona document. This paper shows how we arrived at the personas and how they were applied to design improvements at Quotient.

Couponing Industry

The coupon was invented by Coca Cola in 1887 to increase sales (About us: Coca-Cola history, n. d.). To this day, coupons are used as a marketing tool to increase sales and brand awareness. For example, Procter and Gamble (P&G) would like consumers to try their Tide Pods. To entice consumers to their product, they provide coupons so consumers can try the product at a discounted price. Generally, consumers use coupons to buy products for a lower price with the goal of reducing their grocery bill, but another benefit is to get users to try new products for a great deal. For some consumers the thrill of getting a deal is what keeps them couponing, for others it is a need to keep bills under budget. With all these goals in mind, it was time to take a deeper dive to understand our users to build better experiences.

Methods

Before we start telling you about the methods that worked, let’s visit the ones that did not work.

Personas that Did Not Work Out

We started by talking to different groups within the company about what they wanted to learn and who they thought our audience was. Each product manager believed that they had a specific audience for their product, and it did not matter that the audience could be very different from the other audiences for other products we had, even though our product—coupons and discounts—stayed the same. This was the perception many of our colleagues had of grocery and coupon code couponers. For example, the product manager for grocery coupons thought there was a specific persona who only used grocery coupons, and the product manager of specialty retail thought there was a different persona who only used specialty retail coupons (coupons to use at Ann Taylor or Fox Rent-A-Car codes). This opinion was formed as there was no traffic crossing over between grocery and specialty retail sections of our website. However, we found that a grocery couponer was also a coupon codes couponer, just not at the time they were looking for grocery coupons. They looked for coupon codes at other times; thus, the hypothesis that couponers are only interested in one type of coupon was incorrect.

Another persona we looked into was the mobile-only persona. We found that though users may prefer mobile platforms, they were not using their mobile devices exclusively. If they saw a physical coupon for a product in the store that interested them, they used it, and if they received a relevant coupon at checkout from the cashier, they used it on their next shopping trip. Thus, these findings debunked the mobile-only couponer.

We then took a more rigorous approach to identify our personas by conducting qualitative interviews and validating those findings with a quantitative survey.

Qualitative Interviews

Ten consumers who use coupons for shopping (grocery and retail) were recruited via Craigslist for a 60-minute remote interview; they were compensated with a $25 Amazon gift card for their time. The interviews were focused on why, how, where, and when they use coupons. We also explored how they got into couponing and how their behavior has changed over time. The screener made sure they represented the actual coupons.com population, concentrating on the South East, Central, and Pacific regions of the United States. We chose coupons.com customers and also asked for couponing frequency to include heavy coupon users as well as casual couponer users. The insights in these interviews helped inform the quantitative survey and the basis for our hypothesis that divided our personas into segments—motivation to save and effort to obtain coupons were triggers that divided consumers into our three personas.

Quantitative Survey

The insights from the interviews helped inform the survey we developed to target both our coupons.com users and general couponers. The survey (in the Appendix) consisted on 21 questions that included questions on grocery shopping and saving behavior, retail shopping and saving behavior, and demographics.

Coupons.com audience

Over 10,000 consumers responded to a survey that displayed via a pop-up screen to 10% of our traffic on our consumer-facing websites. Survey questions included questions that were designed to figure out why consumers save, their shopping and saving behaviors, device preferences, coupons.com products used, and so on. The survey helped us segment the audience into categories for their main motivation for using coupons: budget, high value, and convenience. The pivotal question in creating the segmentation was the following:

Which of the following best describes your grocery and household item coupon use?

- I am NOT selective of the coupons I use, and my aim is to get my grocery bill as low as possible.

- I am selective of the coupons I use, and prefer to use coupons for products that support my values (eco-friendly products, etc.) or food preferences (non-GMO, vegan, organic, etc.).

- I mostly choose coupons that are digital (no paper or printed coupons) for the products I buy as it’s convenient to use. I may occasionally use a coupon that I see on a box or some that come with the newspaper/weekly ad as it’s convenient to use.

The information helped with the segmentation with Option 1 representing budget couponers, Option 2 representing high value couponers, and Option 3 representing convenient couponers. We also asked other questions (see Appendix) to get more of an insight into these personas and to validate what was learned in the qualitative interviews. A summary of these learnings by persona is captured in the following Results section.

General couponing audience

We also surveyed general couponers excluding the coupons.com audience to see if our coupons.com data could be mapped to a general audience. We also wanted to see how a general audience is divided into our three personas to compare to our coupon.com audience. Our findings found that the split in the coupon.com (see Table 1 for percentages) audience and the general audience is similar at 30% for Budget, 40% for High Value, and 30% for Convenient Couponers.

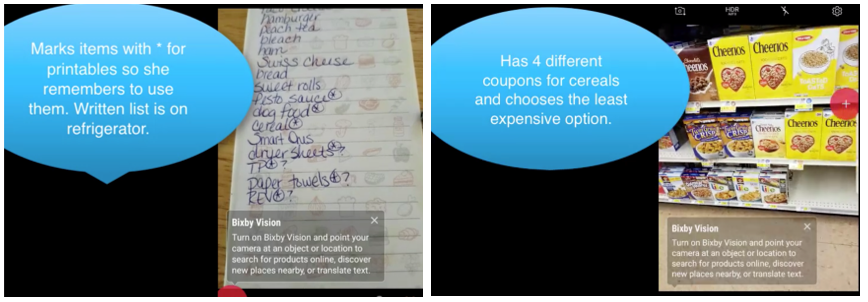

Contextual Interviews and Customer Journeys

We also identified four participants from each persona to take part in some contextual interviews to see how they planned their grocery trips at home by showing us their pantry, refrigerator, and so on. Then we followed them in the store to see how they made their saving and shopping decisions. The interviews and shopping excursions were video recorded. This exercise helped us to better understand each persona and how each persona differed from each other. When we presented our findings, especially the findings from this exercise, it was an eye-opening experience for the leadership team at Quotient and critical in getting buy-in and acceptance for our research. The videos were also great opportunities to improve our product and areas of focus for the future.

Results

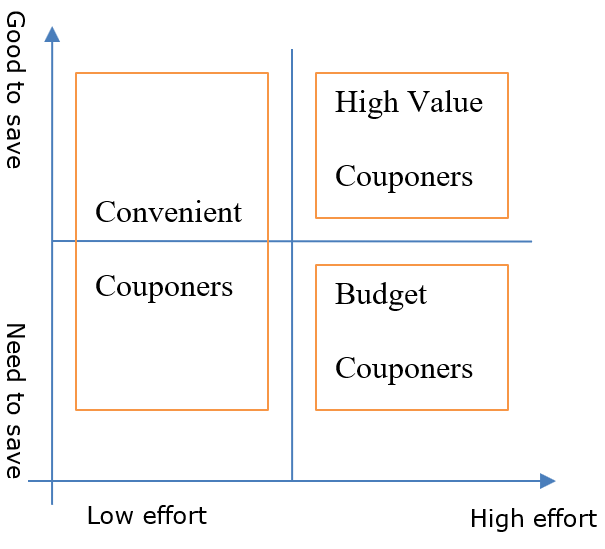

We used qualitative persona clustering methods to segment our personas and found the following two factors to be important in segmenting our consumers:

- motivation to save or is saving as a need or a good habit (need to save, good to save)

- effort consumer is willing to put in to save (high effort vs. low effort)

Motivation to save can be defined as being a need a couponer has to use coupons, or it is not a need but a good habit to save. In the interviews, income was one factor in determining if saving was a need or good habit to have. Low household incomes required customers to save as a need. Of course, what is considered high income in one location of the US may not be high in another location, so factors like location, health concerns, number of family members, and so on were guidelines in identifying if it was a need for the consumer to save or if it was a good habit to have. Effort was determined by the amount of work or time a couponer was putting into couponing.

Figure 1. Personas segmented by effort and saving motivation (need or not).

High effort could be defined as a couponer who would print coupons, add them to their loyalty card, use mobile coupons, and upload receipts to get cash back. Low effort could be defined as someone who does not like printing coupons but is open to low effort ways such as using a digital coupon by using either a loyalty card, mobile coupon, and/or cash back offers.

We could also segment these personas using a very simple equation. Customer happiness for a grocery shopper (as shown in Figure 2) is defined as someone who can get a great deal or lots of savings for quality stuff in a convenient way. Because there are tradeoffs in this equation (quality stuff can be more expensive or convenience can come at a higher cost) customers fall into different groups which is the foundation of our personas. Someone who focuses on savings is our Budget Couponer, someone who focuses on quality and value is our High Value Couponer, and someone who focuses on convenience is our Convenient Couponer. Throughout this paper our demographic is represented by mostly all women because 90% of our audience is female.

Figure 2. Basic formula for customer happiness.

The Budget Couponer needs to save and puts a lot of effort to do so. The Budget Couponers’ main goal is to lower their grocery bill. Generally, this type of couponer has kids at home and is trying to get a coupon for every item on their shopping list They use different ways to save by going to many (about four) stores in the week and finding products on clearance price. For specialty retail, these consumers are going to the clearance section at discount stores like Ross and T.J. Maxx. This group likes to research for deals on their desktop computers and use mobile phones in the store or on the go.

High Value Couponers are those who do not have budget constraints and who save because it is a good habit and they feel good doing it. They put in as much effort into couponing as Budget Couponers; however, they are more selective of the coupons they chose. Deals are good only if it is for something they are planning to purchase. Thus, they focus on value. A coupon could influence when and where they get the item but not necessarily what they bought. For example, if they want deveined shrimp and there was a coupon for regular shrimp, they may not get the coupon as they are selective about what deals they want. The coupons have to fit their values, preferences, and lifestyle, which is different when compared to the Budget Couponers where the coupons dictate what they buy. For specialty retail, these consumers visit both discount and non-discount stores like Banana Republic, Ann Taylor, and so on. This group likes to research for deals on desktop computers and use mobile phones in the store or on the go.

Convenient Couponers think couponing is a lot of effort and only want to save if it is convenient. It is an attitude that consumers have in most aspects of their lives and we could not predict it by income. They mostly use digital coupons and use the occasional print coupon if a cashier gives it to them or if it is visible on the product in the aisle. These are also consumers who invest in home delivery and prefer doing their specialty retail shopping online. This is the group that is most invested in mobile phones to execute their shopping experiences and even consider it while researching for deals.

The details in Table 1 further help differentiate these groups. The data in the table is based on the 10,000+ responses from our survey explained in the Methods section.

Table 1. Persona Details

|

Describing element |

Budget Couponer |

High Value Couponer |

Convenient Couponer |

|

Why do they save? |

Critical to live within their budget |

It is a habit and right thing to do |

It is convenient and can use the extra $ |

|

How are they segmented? |

Higher effort to save and use all offer types—printable, loyalty cards, newspaper, codes, and apps |

High effort to save and use more of card linked offers but also use printable, codes, and loyalty cards |

Low effort to save and use more digital offer types

|

|

Occupation |

stay at home spouse, not working, or working part-time |

full time employed or retired |

student or someone with a temp job |

|

Kids |

2 or more |

2 or less |

2 or more |

|

Household size |

4 or more |

4 or less |

4 or more |

|

Age |

26–55 |

26–65 |

18–65 but skew heavily from 18–25 |

|

Household Income |

$50, 682/year |

$76, 292/year

|

$50,000/year |

|

Percentage of Coupons.com audience |

36% |

34% |

30% |

|

Grocery saving habits |

visit 4 stores/week

spend less than $100/week on groceries

top stores: dollar general, CVS, Target, Walgreens, Walmart

top categories: baby, pets, household, frozen goods, personal care |

visit 2 stores/week

spend more than $100/week on groceries

top stores: Costco, Trader Joe’s, Sprouts

top categories: clothing, electronics, restaurants, household, personal care, baby, and pets |

visit 2 stores/week

spend between $50-$200/week on groceries

top stores: Local grocery store

top categories: food, household, personal care |

|

Retail shopping preferences |

Discount stores: T.J. Maxx, Ross, Marshalls, etc.

Mass merchandisers: Walmart, Target |

Designer+ discount stores: Banana Republic, Ann Taylor, J. Crew, Gap, etc.

Premium department stores: Neiman Marcus, Bloomingdale’s, Nordstrom |

Prefer online and use both discount and premium brands |

|

Coupons.com products used |

Printables, newspaper, circulars, loyalty card, mobile app, codes (lower awareness of coupon codes)

Print at home or work and may or may not own a printer

Use laptop to search for coupons and mobile on the go |

card linked offers, codes (lower awareness of coupon codes) from Google search, mobile app, printable, loyalty coupons

Own printers and print at home

Use laptop to search for coupons and mobile on the go

|

Use coupons that are convenient so digital preferred

Also use newspaper coupons that come in snail mail

Print from work or school as do not own printer

Use laptop and mobile to search for coupons |

|

Frustrations/ Needs |

Need more coupons for products I use

Takes too much time to find relevant offers

Does not support stores in my area

Not easy to use—pre-clip, print issues, mobile print issues, store specific coupons, coupons not updated often |

Want high value coupons—organic, healthy products, environment friendly.

Takes too much time to find relevant offers

Forget to use

Not easy to use–pre clip, offer restrictions, too many offer types, printing issues |

Codes do not apply to me (50%)

Takes too much time to find offers (40%)

Expires too soon (40%)

In-store deals better when they actually go to mall |

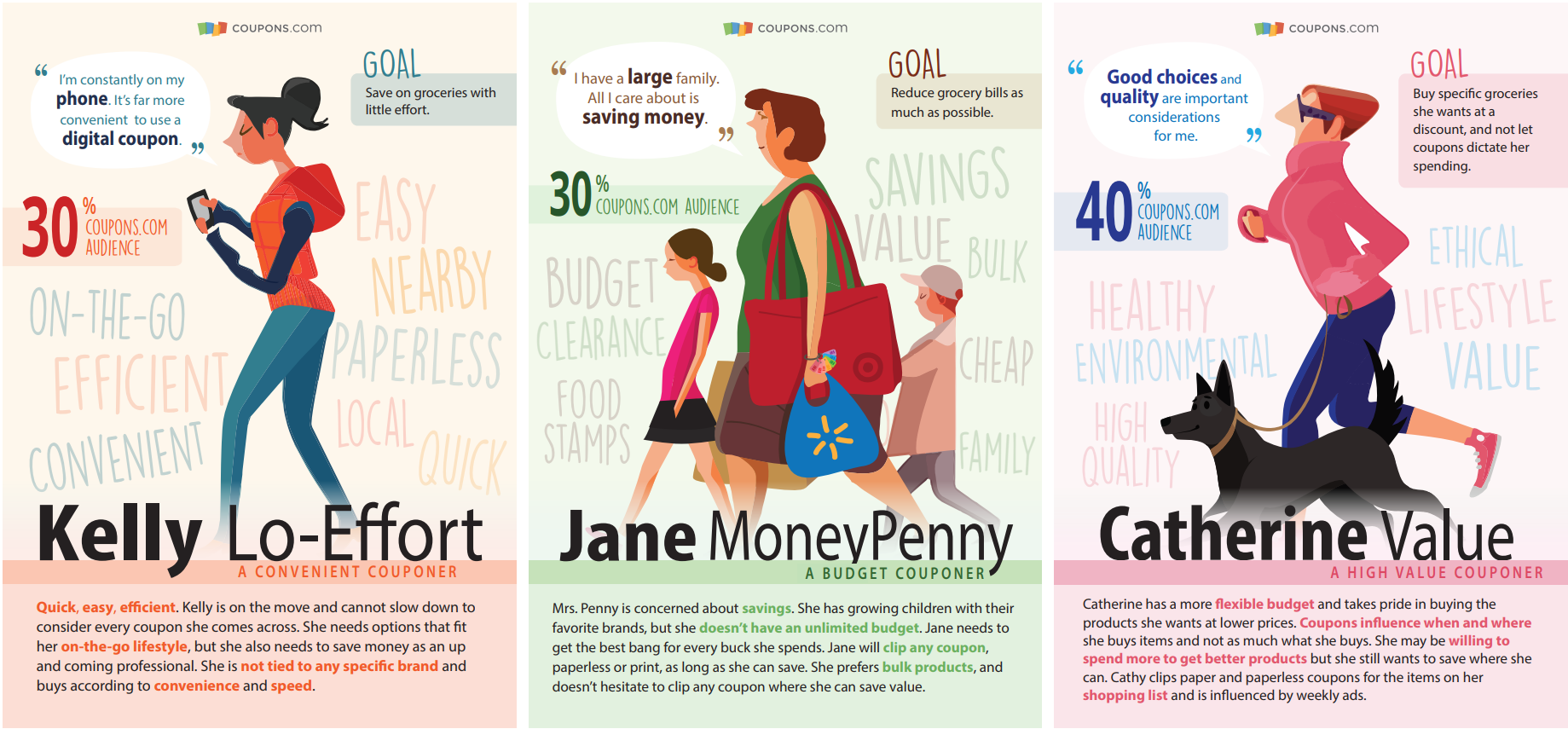

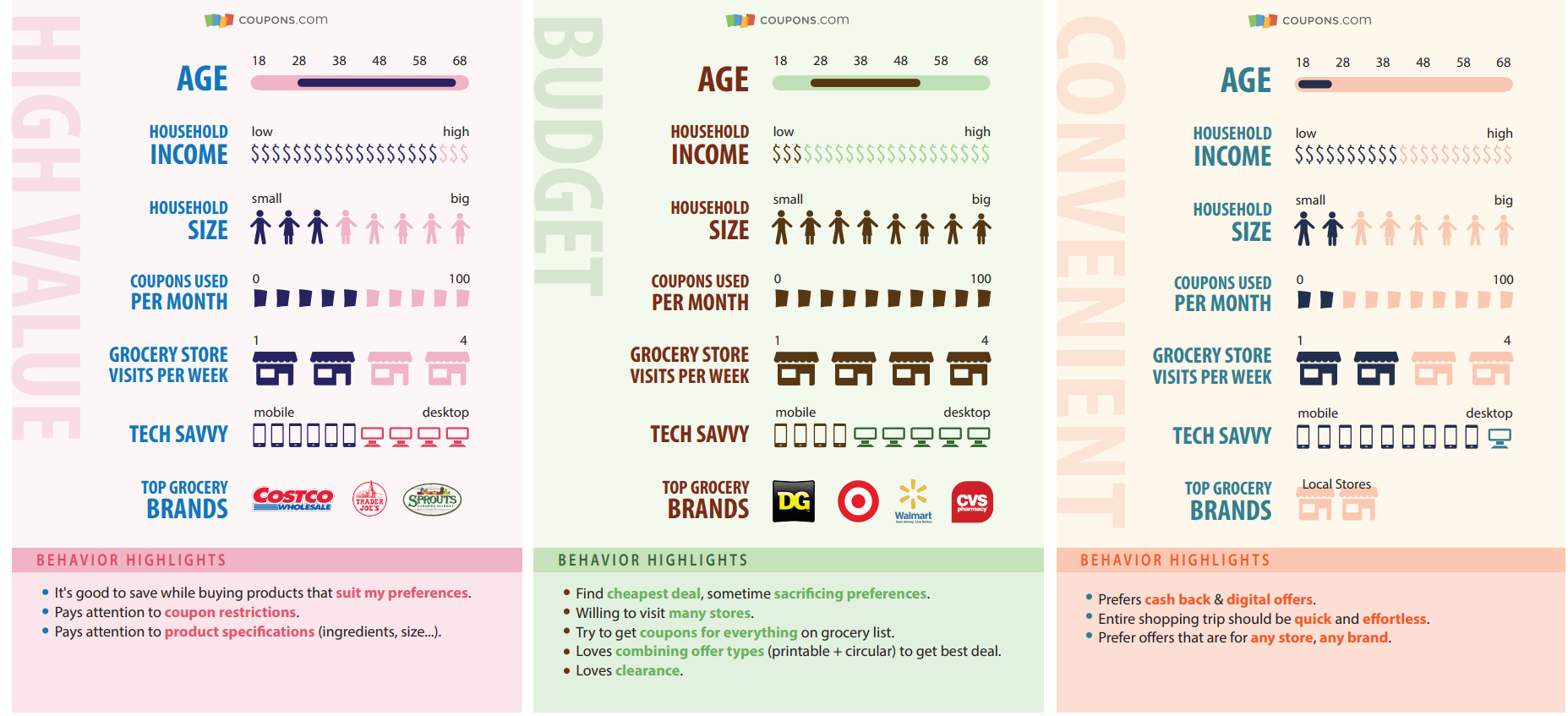

Persona Posters

We used the information we collected above to create a persona poster as shown in Figures 3 and 4. We consciously limited what was on the poster to the most critical information so that someone who read it for the first time did not think it was too little or too much information all while capturing the essence of the persona. After many design iterations, we decided that the front of the poster would have a description of the persona and her main goal. It also contained how much of our audience she represented, as well as some keywords that were associated with that persona. The back of the poster had some persona defining information: age, income, household size, coupons used per month, grocery stores visited per week, tech savviness, and top grocery brands. It also had some key behavior highlights. This information represents a good mix of demographics that could identify the user while applying some industry-specific information that could inform employees of her activity on our websites and mobile app. Information is in the form of infographics to help make these comparisons easily and communicate the information more efficiently. The poster can be printed on a 15.5- by 7.5-inch sheet of paper or paper from any office printing machine. A conscious effort was made to place the personas side by side so employees could compare and understand the differences easily. Caricatures were chosen over pictures of people as couponing is a sensitive topic that is influenced to some degree by income. We also stayed away from ethnicity.

Figure 3. Front of the three persona posters.

Figure 4. Back of the persona poster.

Persona Customer Journeys

To better understand our personas, we followed four participants from each persona group on their shopping journey to see the different aspects and subtle nuances of each group. We followed each participant separately on their grocery shopping journey, from planning at home to going to the stores. Below is a screenshot of the video of the Budget Couponer planning her list at home, marking with an asterisk (*) the items that have coupons; the second screenshot is of her going to the cereal aisle in the store to buy the cereal with the best deal. These journeys were the single most important artifact in communicating the personas to the entire organization. It truly brought a shared understanding to the goals, needs, and frustrations of our customers.

Figure 5. Picture of video of a participant planning at home (left image) and shopping in the store (right image).

Designing with Personas

We are always trying to improve the coupons.com experience, and this exercise to identify our personas was one way to find improvements. Some ideas have been listed in the following sections on how we introduced features and ideas to cater for each persona’s needs after conducting our research on the personas.

Budget Couponer

A Budget Couponer loves to maximize savings and reduce her grocery bill as much as possible. She may even change her meal plan for the week to use products that have great offers. Budget Couponers love buy-one-get-one free offers (BOGOs), stacking (combining a manufacturer offer with a retailer discount for the same product thus getting twice the benefit), and clearance items. We discovered that the Budget Couponer love to shop at Walmart, so it was obvious that we needed to add Walmart offers to our gallery of coupons (Figures 6 and 7). Our data showed that this type of coupon gallery had the fastest growing digital offer store.

Figure 6. Walmart store added to our portfolio to cater to our Budget Couponer.

Figure 7. Mobile app view of the cash-back Walmart offers.

Another thing Budget Couponers love to do is to check out the circular (also called weekly ads as it has a list of items on sale at that store) for the stores they visit. Then they decide which store to go to (or start with) and usually select the store with the most relevant offers for the items they want to buy that week with the best deals. For example, the Whole Foods circular is shown in Figure 8.

Figure 8. Whole Foods Circular to let Budget Couponers find which store to go to based on that week’s deals.

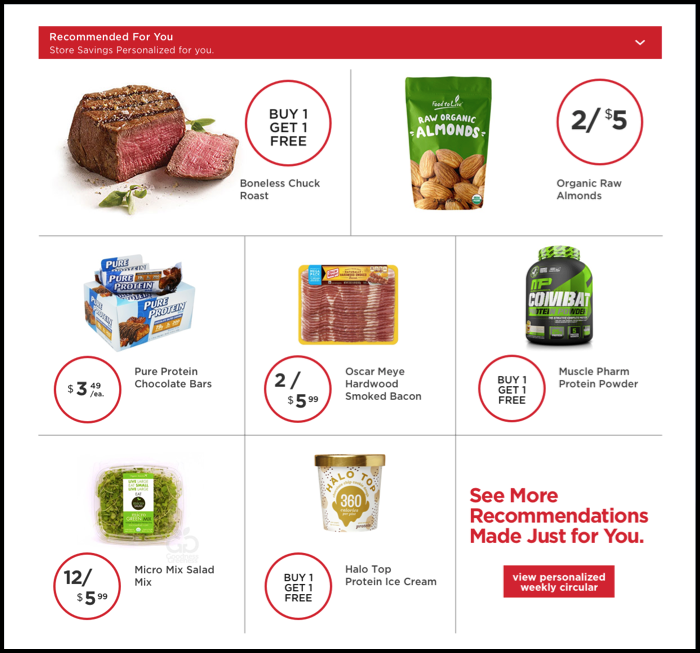

High Value Couponer

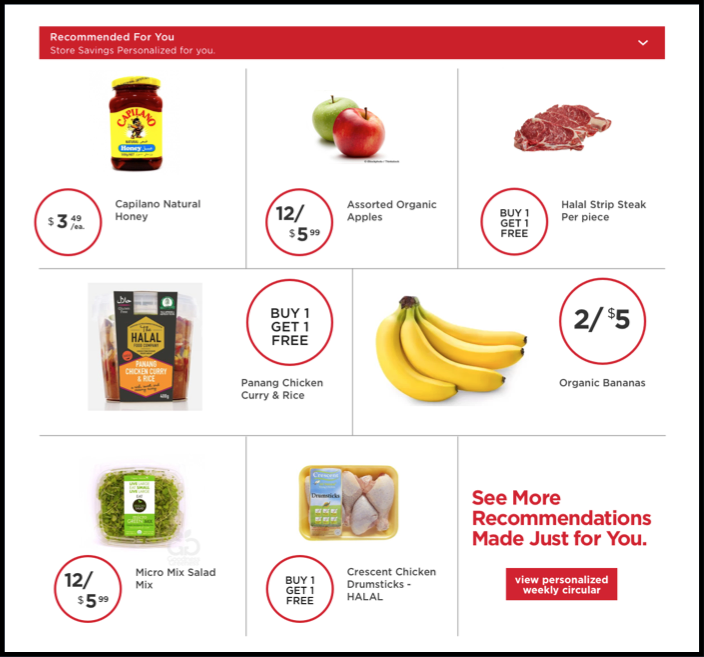

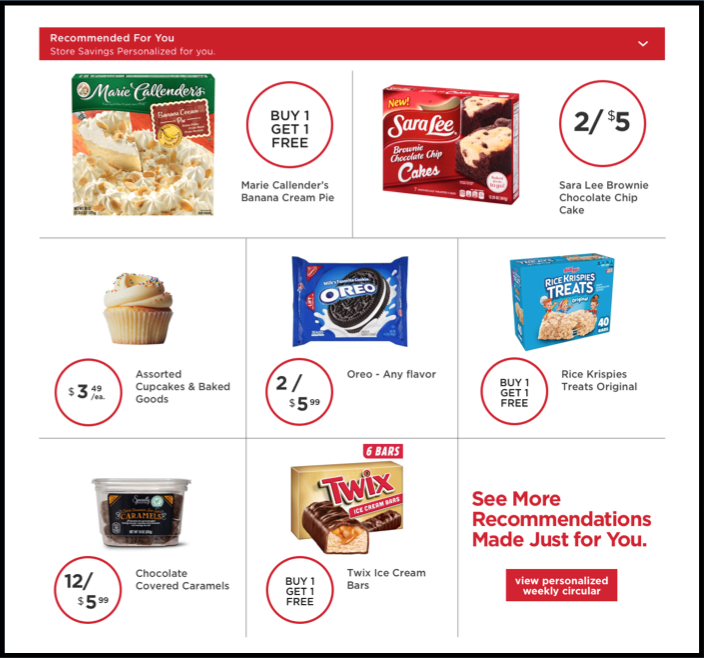

A High Value Couponer has a more flexible budget and focuses on getting deals for products she needs as opposed to deciding on products based on deals. She wants the freedom of choosing offers and wants her values and preferences to dictate what to get. For example, some preferences may be a diet-based choice, such as for a keto diet. In other cases, it may be product specific like wanting nonstick aluminum foil instead of the regular foil. Usually, coupons can influence her to visit a specific store or buy products earlier (so when and where), but do not heavily influence what she buys. Thus, personalization and clarity of coupon restrictions are important to a high value couponer. Better quality products are also a focus so emphasizing the value in addition to the deal is important. In the examples below, we show our new circular product personalized for each person. For example, in Kel’s circular (Figure 9), he sees Keto diet supported items, while Mohammud’s circular (Figure 10) is personalized to support halal products, and Jenn’s (Figure 11) preferences are skewed towards dessert.

Figure 9. Kel’s circular supporting his Keto diet.

Figure 10. Mohammad’s circular supporting his halal diet.

Figure 11. Jenn’s diet supporting her dessert cravings.

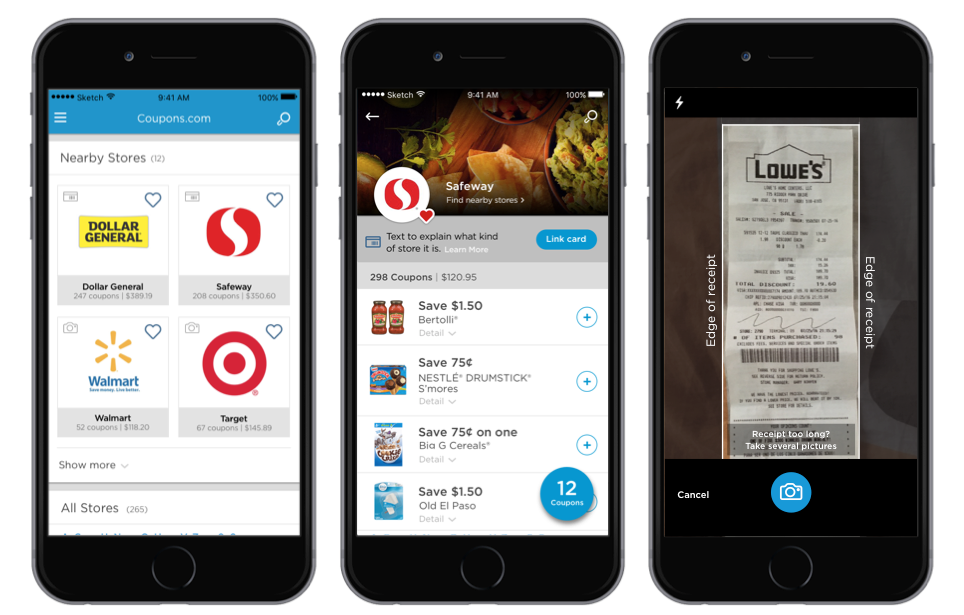

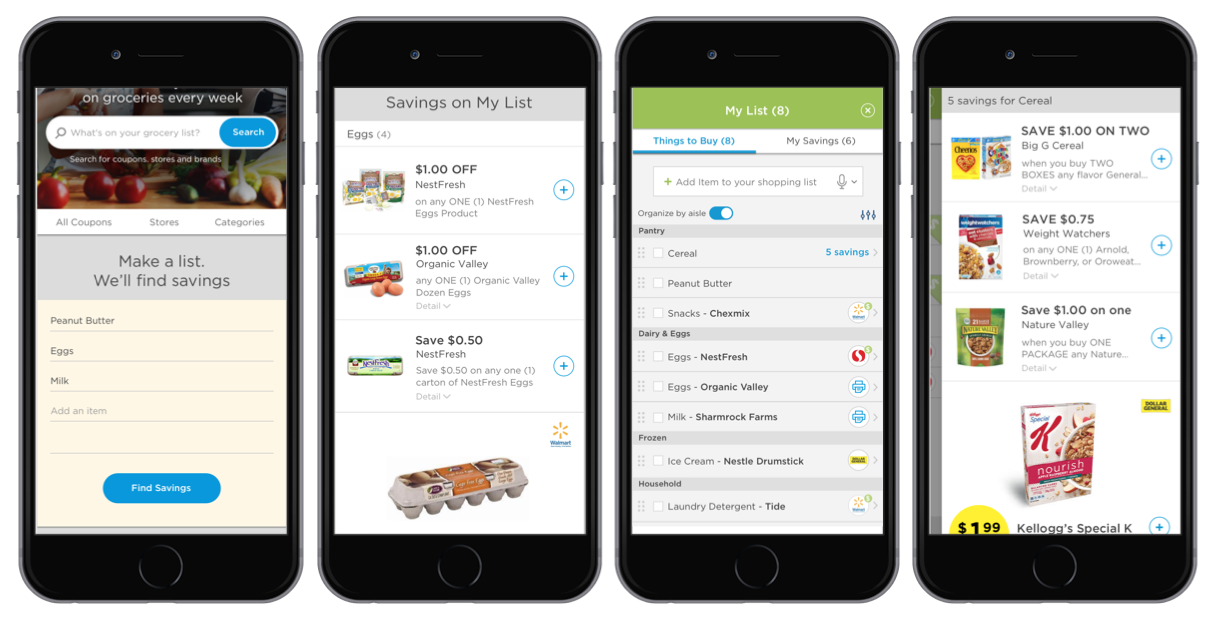

Convenient Couponer

A Convenient Couponer will save if it is convenient. Convenient Couponers make it clear that they will coupon if it is effortless like using digital over printable options and in some cases getting discounts after shopping by uploading the receipt. Convenient Couponers tend to go to the nearest store. The best way to attract this audience is to provide them with the right coupon at the right time and place. The features on our mobile app cater to this audience. Figure 12 shows examples of offers in nearby stores, digital offers, and receipt scanning (to upload and get cash back) if the groceries have been purchased.

Figure 12. Screenshots of options that a Convenient Couponer may like.

In another example, a feature called “couponify” is currently being worked on where a couponer can couponify her grocery list, and the offers are automatically found and added to the list by the click of a Couponify button as shown in Figure 13.

Figure 13. Couponify makes it easy to find a coupon for all items on your shopping list.

Designing for All

Through this exercise, we identified different types of couponers, but it also brought us back to the basic needs of all couponers. We found some of the best design ideas contributed to all personas. Though we have a mature product, a persona exercise makes us revisit user needs and the needs that may not have been addressed due to technical limitations or other reasons. Thus, when it comes to an exercise like this, we can go back to making the product better by focusing and prioritizing on the basic needs of a couponer. For example, providing the right coupon (via personalization) at the right time (via geolocation or other factors) helps all personas. Another example is providing a savings meter (how much you saved over time) to encourage all personas to save more, making it a win-win situation for the company and the customer. It is important to understand the different needs of our personas, but it is also important to know the core goals of your product and what ties all your personas together. Prioritizing user needs before getting into the differentiators is a good strategic first step.

Overall Impact on Design

The personas have had a great impact on the design process and how we talk about design in the organization. This was an intangible but direct result of the process. The designers feel equipped to make design decisions based on “If this is for the Budget segment, it should be …”. The conversation in design reviews have changed to “Which user segment is this project for?” and “How does this fulfill the persona goals?” It is empowering designers and product thinkers alike to make more informed decisions about small interactions as well as the product roadmap. This is a big step in changing the culture of the company to a more user-centered design environment.

Communicating Personas and Building a Design Culture at Quotient

The exercise to create the personas and the exercise to communicate them to employees should be well thought out. At the end of the day, a successful exercise is when you can rally the entire organization to understand and execute on projects that successfully cater to customer needs. This is one exercise in building a design culture at Quotient and in truly being a customer-centric company. Employees need to participate in understanding our users and to identify the user needs that are not met and provide possible solutions to those needs.

Through this exercise, we communicated to all Quotient employees that understanding our customers can help us recognize new product opportunities that would lead us to innovation which in turn leads to having successful products. And the only way we can create successful products that customers love to use, products that meet our business goals as well as leverage technology and data, is when we focus on our customers and empathize with them. Getting to know our customers, their habits, pain points, motivation, what they like and dislike about our products, and which of their needs are not yet met by our products, is part of this process.

We also communicated the importance of putting deep customer understanding into everything we do at Quotient from research and design strategy, marketing and sales to all other aspects of the company. We all focus on creating experiences that build meaningful and lasting relationships with our customers which is the heart of Quotient being a design-led company.

The next sections highlight some ways in which we communicated our personas to our employees.

Individual Workshops for Various Teams

We started with individual workshops for different teams (engineering team, product team, and mobile team) that were more detailed in the explanation and communication of these personas. For example, the mobile team went deeper into the convenient persona and how we could cater to their needs. The workshops were information sharing sessions with persona descriptions and videos of customer journeys. Persona posters were shared too, and we also had an open discussion window where employees shared ideas and asked questions.

Presenting to the Entire Company

We also presented the personas in an easy to understand talk for the entire company. This two-part talk series lasted about 45 minutes each. The first part included an introduction to the personas and each employee received a postcard or short description of the personas as shown in Figures 3 and 4. This helped employees absorb and think about the information. The second part included a section on using personas to help guide the design of our products. The persona examples helped employees see how each persona could be applied to the user experience. We also had a contest where employees had 15 minutes to send us their ideas via Slack; more details on the contest are given in the next section. Employees had the opportunity to purchase the t-shirts that we made for the design team (Figure 14) to help them connect to their customers and be proud of making products customers love.

Figure 14. Design culture t-shirts.

Persona Contest

In our second talk, employees had the opportunity to participate in a contest to come up with the best idea to motivate users to save more for each persona given their needs and behaviors. We received 59 ideas via Slack, and we voted for three winning ideas. Winning ideas were judged on four criteria: impact to the persona’s shopping experience, simplicity, clarity, and the quality or how well does the solution address the persona need. There were nine judges (four of which are authors on this paper) from the Product Design team. Each judge voted for three top ideas, and the winners were based on the most votes in each persona/customer segment. Winners received a $50 gift card. The winning ideas are listed in Table 2.

Table 2. Persona Contest Winning Ideas

|

Persona |

Goal |

Proposed Idea |

|

Budget Couponer |

Motivate them to save more. |

Implement a meter measuring how much they have saved and give them a goal to motivate them to coupon more. |

|

High Value Couponer |

Provide a system to make it easier to find and use coupons. |

Capture the shopping behavior of the customer and categorize the list into, for example, weekday purchases and then recommend (pop-up) coupons as the weekend is approaching (for example, on a Friday). The recommendations could be voice-based commands to a device (like Alexa) or an app. This saves not only money but the time it would take to write or type it out. |

|

Convenient Couponer |

Influence to use more coupons even when they typically would not choose to. |

Gamify the coupons.com app use. Show overall savings meter (all time). Create different levels that a user reaches when they have clipped a certain number of coupons or saved a certain amount of money. |

Resurrecting Dead Personas

Personas can quickly fade and die after their initial communications. As explained in Pruitt and Aldin’s (2006) persona life cycle in Table 3, the concept of personas can be resurrected if we continue to focus on the main goals of the persona how we want future experiences to be for these personas, and how can we measure those changes.

Table 3. Tamara Adlin and John Pruitt’s Essential Persona Lifecycle Format

|

Goal or issue |

How things are today |

How we want things to be tomorrow |

Ways to measure change |

|

A problem you would like your personas to solve |

A description of the current state of affairs |

A description of the “first step” in achieving your goal |

A description of analytics, research, or other methods you can use to measure your progress |

Table 4 provides an option on how we want things to be in the future for the three personas presented in this paper.

Table 4. Adapting the Essential Persona Lifecycle Format to Our Personas

|

Persona |

Goal or issue |

How things are today |

How we want things to be tomorrow |

Ways to measure change |

|

Budget Couponer |

Reduce grocery bill as much as possible. |

Spending many hours combining deals across various offer types (printable, digital, etc.) for each item on their grocery list to maximize savings |

Provide net downs (or combined deals/offers) for items on shopping list.

|

– An increase in Net Promoter Score (NPS) -Increase in activations (or usage) of these combined deals/offers |

|

High Value Couponer |

Buy specific groceries she wants at a discount and not let coupons dictate her spending.

|

Looking for coupons for items on her grocery list and not using a coupon if it is not available |

Gather high value products for each category and sub-category by explicit and implicit ways. |

– An increase in Net Promoter Score (NPS) -Increase in activations (or usage) of these offers |

|

Convenient Couponer |

Save on groceries with little effort.

|

Using mostly digital coupons as she does not want to print them out |

Select once to redeem all offer types. |

– An increase in Net Promoter Score (NPS) -Increase in activations (or usage) of these offers |

Personas and Their Impact on Overall Strategy

Personas are mainly used to help communicate design. Some times during the persona development process, you can also find gaps in the overall product strategy that are not catering to the needs of customers. For example, we always knew our customers were on a budget and loved to save, but we also found a customer segment that was willing to be more flexible for a higher price and better value (High Value Couponer). This insight is helping inform our overall strategy to focus on offers that cater to this segment and not just the current products offered by the Consumer Packaged Goods industry. We have been collecting user preferences on high value products so our sales teams can specifically target those offers. In another example, we learned that our Convenient Couponer wanted to make the entire couponing process seamless (scan one barcode to use for all offers) but the coupon industry and technical limitations have not yet been able to provide this solution. This insight has accelerated our platform, and an advanced research team is looking into a possible seamless solution.

Conclusion

Personas worked well in aligning the company towards a common understanding of our user needs and goals and evangelizing our design culture. We are continuing to focus on the user goals while impacting overall strategy and measuring changes for short-term and long-term goals.

Tips for Usability Practitioners

The following tips may help practitioners when using personas in their research:

- While grouping persona characteristics, keep it simple. It was effective to communicate our personas to employees because each persona had an easily understandable core attribute: savings, quality, and convenience.

- Different audiences need different persona communication documents. For example, at the leadership level, we used videos that highlighted how personas go through their journey in different ways to showcase different needs and goals. For the marketing team, it was about demographics, needs, and goals. For the product team, it was about the pain points and opportunities in addition to needs and goals.

- Including the company in your persona journey via a contest or an idea channel on Slack brings different perspectives and ideas on how to solve problems and further define user needs and goals.

- Understanding the needs of each persona is important, but it is also important to know the business and technical perspectives to help determine which features can be built first. This helps in prioritizing those needs before getting into the different needs of each persona. while always making sure.

- Personas are a useful tool to design a delightful user experience. However, different research methods do bring different perspectives and are used to solve different research and business goals. It is important to have exposure to these different perspectives and get a 360-degree view of our customers while also considering business and technical goals.

Acknowledgements

We are grateful to Casey Hamlyn, Jhinak Sen, and Stephanie Stallworth from our Analytics and Research team for staying with us on our journey and helping us with the analytics and segmentation of this study. We would like to also thank Evie Goldstein for helping us with the copy writing.

References

About us: Coca-Cola history. (n. d.). Retrieved from https://www.worldofcoca-cola.com/about-us/coca-cola-history/

Blomquist, A., & Arvola, M. (2002) Personas in action: Ethnography in an interaction design team. Proceedings of the second Nordic conference on Human-computer interaction, NordiCHI (pp. 197–200). Aarhus, Denmark: ACM.

Cooper, A. (1999). The inmates are running the asylum: Why high-tech products drive us crazy and how to restore the sanity. Sams Publishing.

Pruitt, J., & Aldin, T. (2006). The persona lifecycle: Keeping people in mind throughout product design. Morgan Kaufmann Publishers: San Francisco, CA, USA.

Appendix: Survey

The following is from our survey that we gave coupons.com users and the general couponing audience. The first two questions are to screen for couponers and the other 19 questions gather data on grocery and retail shopping, saving behavior, and demographics.

- Are you the primary shopper in your household for grocery and household items (i.e., food, household goods, pet, baby, etc.)?

- How often do you use coupons for grocery and household items (food, cleaning products, health care, personal care, baby products, etc.) at stores you visit in-person?

- Every shopping trip

- More than half of shopping trips

- Less than half of shopping trips

- Never

- Which of the following best describes your attitude towards couponing? Select the statement that best describes you and tell us why that best describes you in the text box below.

- I am not selective of the coupons I use, and my aim is to get my grocery bill as low as possible.

- I am selective of the coupons I use, and prefer to use coupons for products that support my values (eco-friendly products, etc.) or food preferences (non-GMO, vegan, organic, etc.).

- I mostly choose coupons that are digital (no paper or printed coupons) for the products I buy as it’s convenient to use. I may occasionally use a coupon that I see on a box or some that come with the newspaper/weekly ad as it’s convenient to use.

- Other

- During a typical WEEK, about how much does your household spend on groceries, food, household goods, pet, baby, over-the-counter health and/or personal care items?

- Less than $25

- $26–$50

- $51–$75

- $76–$100

- $101–$150

- $151–$200

- $201–$300

- More than $300

- Which types of coupons do you use for groceries and household items? Select all that apply.

- Coupons received at the register, in the aisle, etc.

- Coupons clipped from newspaper, mail, magazine, etc.

- Coupons on product (peeled off, hanging on, in/on the box, etc.)

- Mobile coupons scanned on your mobile device during checkout

- Paper weekly ads or circulars

- Online weekly ads or circulars

- Coupons you print yourself from an online or mobile source or email, etc.

- Coupons where you scan your receipt on a mobile phone to receive cash back

- Loyalty or reward coupons that are uploaded to a store loyalty card

- Which sites OR apps do you visit for grocery coupons? Select all that apply.

- com

- com

- com

- Checkout51

- Ebates [now called Rakuten Rewards]

- Shopkick

- Store coupon website or app (Walmart, Target, etc.)

- Store coupon mobile app with digital coupons linked to your loyalty card (Dollar General, Safeway, Walgreens, etc.)

- ibotta

- MobiSave

- Other (please specify)

- In the past 3 months, which stores did you visit for your groceries and household items? Select all that apply.

- Kroger

- Publix

- Giant Eagle

- Meijer

- Costco

- Walmart

- Sam’s Club

- Winn Dixie

- Ahold

- Sprouts

- Family Dollar

- Big Lots

- Target

- Save A Lot

- Dave’s Markets

- Heinen’s Fine Foods

- Whole Foods

- Safeway

- Harris Teeter

- Vons

- Food Lion

- Lowes Foods

- Ralphs

- Albertsons

- ShopRite

- Dollar General

- Fry’s

- Michael Foods

- Stater Bros.

- Price Chopper

- Giant Food

- Weis Markets

- Hannaford

- Other (please specify)

- What is your retail (clothing, shoes, accessories, etc.) saving philosophy? Select all that apply.

- I shop at clearance sales at discount stores (T.J. Maxx, Ross, Marshalls, Kohl’s, Dillard’s, etc.).

- I shop at sales at non-discount stores (Banana Republic, Nordstrom, etc.)

- I mostly buy online as it’s less expensive.

- Which Coupons.com products have you used? Select all that apply.

- Printable grocery coupons

- Coupon codes/promotion codes

- Loyalty card coupons

- Credit card-linked offers

- com mobile app

- I don’t use Coupons.com products but use coupons from elsewhere

- What device do you use to search for coupons? Select all that apply.

- Laptop/desktop

- Mobile phone

- Tablet

- Other: newspaper

- What device do you use most often to search for coupons?

- Laptop/desktop

- Mobile phone

- Tablet

- Would you be willing to share your purchase data and preferences in order to get personalized deals?

- Yes

- No

- Only with some that I trust

- What type of shopping list do you use?

- I use a paper list and mark which items have coupons.

- I use a paper list and do NOT mark which items have coupons.

- I use an online list (let us know which one below).

- I use a combination of online (let us know which one below) and paper lists.

- I don’t use a shopping list.

- What is your ethnicity?

- American Indian or Alaskan Native

- Asian or Pacific Islander

- Black or African American

- Hispanic or Latino

- White / Caucasian

- Prefer not to answer

- Other (please specify)

- How would you describe your work status?

- Working full time

- Working part time

- Student

- Stay at home parent

- Not currently working

- Retired

- How many people currently live in your household (including yourself)?

- One

- Two

- Three

- Four

- Five

- More than 5

- How many children (under 18) live in your household?

- None

- One

- Two

- Three

- Four

- More than four

- What is your age?

- 18–29

- 30–44

- 45–59

- 60+

- What is your gender?

- Female

- Male

- Other

- Prefer not to answer

- How much total combined money did all members of your HOUSEHOLD earn last year?

- $0 – $9,999

- $10,000 – $24,999

- $25,000 – $49,999

- $50,000 –- $$74,999

- $75,000 – $99,000

- $100,000 – $124,999

- $125,000 – $149,999

- $150,000 – $174,999

- $175,000 – $199,999

- More than $200,000

- Prefer not to answer

- Your location?

- East North Central

- East South Central

- Mountain

- Middle Atlantic

- New England

- Pacific

- South Atlantic

- West North Central

- West South Central